In the unique world of student housing, challenges are as diverse as the students themselves. Unlike traditional multifamily housing, student housing operators face a range of issues, from dealing with first-time renters who have always lived at home, to managing the intricacies of parental guarantors and financial aid, to the perennial problem of no-shows and skips.

The unique challenges of student housing

For many students, signing their first lease is an unfamiliar experience. Leasing teams spend significant time explaining lease terms, often to parents who co-sign but can face financial hardships like job loss, a situation exacerbated during unexpected events such as the COVID-19 pandemic. This constant need for communication between owners and personal guarantors to get a lease signed is just one layer of complexity.

International students, student athletes on scholarships, and those receiving financial aid present additional challenges, often lacking a personal co-signer. Operators strive to make housing accessible to all students but frequently lack simple guarantor solutions for these cases.

Further complications arise from no-shows on move-in day, leading operators to over-lease or scramble to fill vacant beds. At the end of the school year, some students leave early, skipping out on final rent payments and forcing operators to chase personal guarantors for payment.

Enter lease guarantees

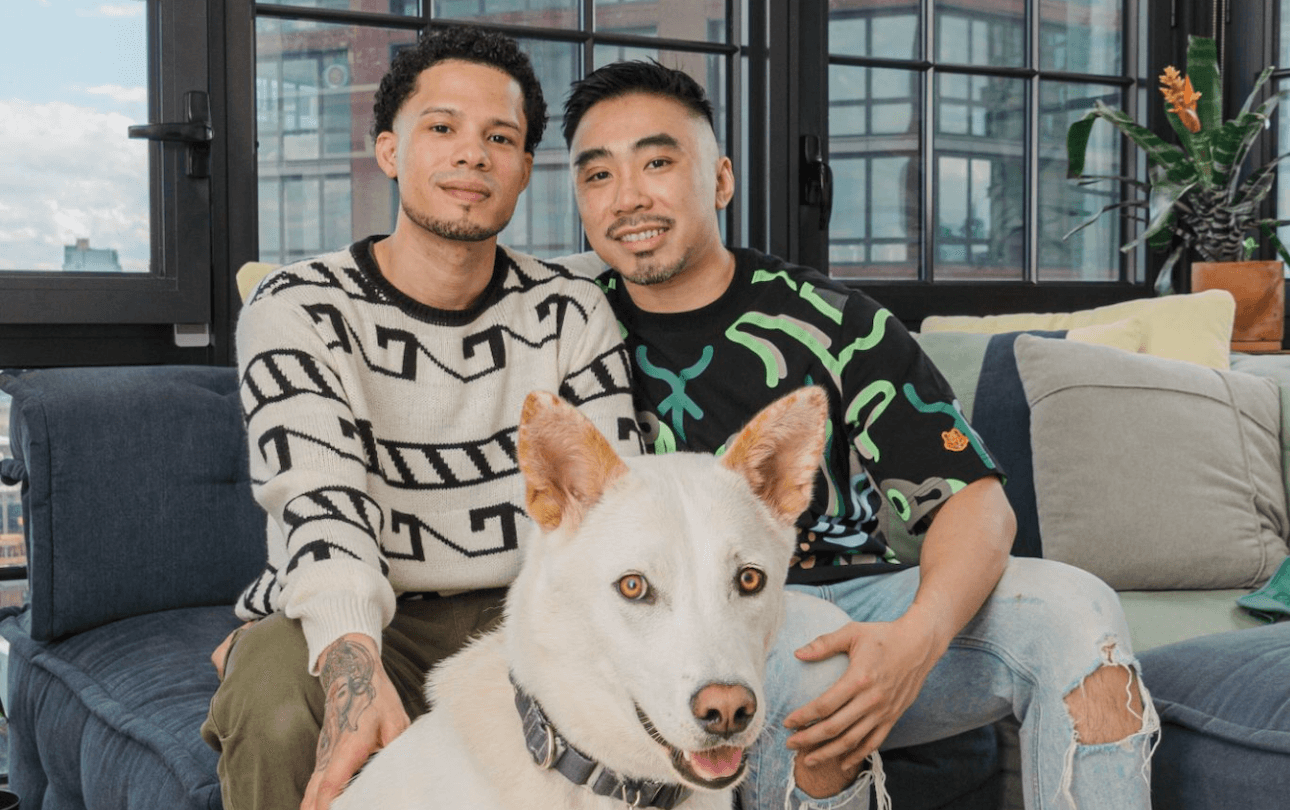

"Dealing with these problems is a headache for operators," says Micah Hollingsworth, Director of Student Housing at TheGuarantors. Offering lease guarantees, deposit replacements, renters insurance, and compliance solutions, TheGuarantors provides a comprehensive safety net for operators. "Our student rental income coverage helps leasing teams approve more students, saves significant time on administrative tasks, and minimizes financial risk for every bed in their property," Hollingsworth explains.

Lease guarantees protect owners and operators against defaults, skips, no-shows, and other risks, effectively replacing the need for personal guarantors. Although a relatively new solution, adoption is growing rapidly in the student housing market. Since its founding in 2015, TheGuarantors has secured over $3.5 billion in rent and deposits nationwide, guaranteeing a student renter about once every 10 minutes.

A booming market with persistent challenges

Despite the challenges, the student housing market is performing well. Pre-leasing trends from 2019 to 2022 were over 10% ahead of average, and the average rent per bed increased by 5.2% year-over-year, according to a report by Yardi Matrix.

However, the young renter demographic, with limited credit history and reliance on parental guarantors, presents a unique array of headaches for owners and operators. Many student renters are unaware of rental obligations or struggle to pay rent during difficult circumstances.

Comprehensive protection for all

TheGuarantors' offerings extend beyond lease guarantees, including security deposit replacements, renters insurance, and master tenant liability policies. "Our core focus with our student product is to provide our student housing partners with comprehensive property-wide protection," says Hollingsworth.

If a student doesn’t show up, defaults, damages a unit, or skips out early, TheGuarantors steps in to cover those losses. At the same time, a lease guarantee allows a student to move into an apartment they might not have otherwise qualified for, creating a safety net for both students and operators.

Reliable deposit coverage

A noteworthy trend in student housing is the move away from collecting upfront security deposits. While beneficial for students, this shift introduces increased risk for operators. Security deposit replacements offer a solution: instead of paying a large upfront cash deposit, students pay a non-refundable fee to purchase deposit coverage from a partner like TheGuarantors. This arrangement is often less costly for students and provides greater financial protection for operators.

"Owners and operators can think of us as an extended arm of their team," says Hollingsworth. TheGuarantors offers multilingual customer support and a dedicated in-house team that proactively contacts delinquent students to help resolve payment issues. Operators can customize coverage based on their specific needs.

The future of better partnerships

A common question is how students qualify for a lease guarantee. TheGuarantors uses an AI-based underwriting model built from over 2,000 variables, predicting renter default with 89% accuracy.

Operators are seeing positive results. B.HOM Student Living partners with TheGuarantors to increase access and reduce move-in costs for students while enhancing its own risk protection. This partnership has helped B.HOM secure over $13 million of its rent roll without increasing operating expenses. "A service like TheGuarantors can truly make a difference and let student housing operators focus on what’s most important," says Hollingsworth.